Forex pivot points are a technique used by professional traders and managers to help determine the potential support and resistance areas. Simply put, a forex pivot point and its support and resistance levels are areas where the price can move.

Why they are objective.

In many ways, forex pivot points are similar to Fibonacci levels. The fact that many people are looking at these levels makes them almost self-fulfilling.

The main difference between the two is that with Fibonacci, there is still some subjectivity involved in choosing the ups and downs Swings. With forex pivot points, traders often use the same method of calculation.

Many traders keep an eye on these levels and you should too.

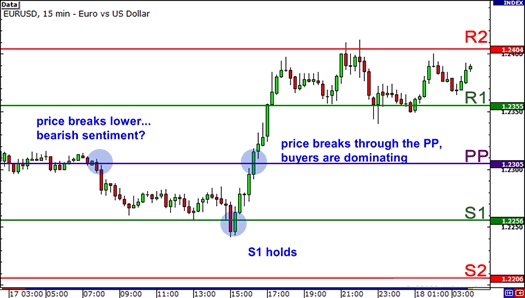

Forex pivot points are especially useful for short-term traders who are looking to take advantage of small price fluctuations. As well as the normal levels of support and resistance, traders can operate from the jump or break in any of these levels.

Other forex traders use pivot points to identify reversal points. See pivot points as areas where they can place purchase orders or sale.

Still other traders use forex pivot points to recognize key levels that need to be broken for the movement to be classified as a real escape.

Here are some easy to memorize tips that will help you make smart decisions operations using forex pivot points:

– There framework ways to calculate the pivot points: the standard way, woodie, Camarilla and Fibonacci.

– Points forex pivot can be extremely useful in Forex since many currency pairs tend to fluctuate at these levels. Most often, the price varies between R1 and S1.

– Forex pivot points can be used in range operations, fleeing and trends.

– Band operators to enter a buy order near identified levels of support and a sell order when the pair nears resistance.

– Forex pivot points also allow breakout traders identify the levels that need to be broken so that the movement qualifies as strong momentum.

– Trend traders use forex pivot points to help determine the feeling of high or low of a currency pair.

– The simplicity of forex pivot point becomes a useful tool to be added to your trading toolbox. It allows you to see the possible areas that might cause price movement. You will get more in sync with market movements and make better business decisions.

– Use the analysis of forex pivot point is not always enough. Learn how to use the forex pivot points, along with other technical analysis tools as standard candles, MACD, moving averages, Stochastic, RSI, etc. The higher the confirmation, the more likely your business success!